Tysers Insurance Brokers warns of the dangers of underinsurance in the construction industry, as many businesses risk having to make up the shortfall if their policy does not provide sufficient cover

Client A suffered a flood on October 2nd 2023, which caused damage to machinery and stock totalling £60k. Client A had a Commercial Combined policy in place; however, the machinery was underinsured* with their policy only covering 30% of the total value.

After the claim was assessed, the loss adjuster applied the “Average Clause**” to the whole claim, offering Client A just £19k compensation, a massive shortfall compared to the damage caused by the flooding.

Tysers challenged the adjuster on the basis that only the machinery was underinsured, with the rest of the cover being sufficient to cover the damage to stock, and the adjuster correctly applied the “Average Clause” to the machinery claim only, which was around £10k. This resulted in an improved offer of £47k total, which was accepted by Client A.

This case demonstrates two important lessons for businesses of all sizes. Firstly, the importance of having adequate insurance to cover all stock, machinery and contents that may be damaged by flooding, fires or other perils.

It also underlines the value of having an experienced construction insurance broker and claims team who can negotiate on your behalf when claims occur to ensure you get the best outcome.

What is underinsurance?

Underinsurance occurs when the policyholder has insufficient cover for their needs.

An underinsured policyholder still has some level of cover, but when claims are settled the financial compensation received from insurers will be less than the amount needed to rebuild, replace stock or cover business interruption costs.

There are many areas where a business may be unknowingly underinsured from building, stock and contents cover to business interruption and cyber liability.

An experienced construction insurance broker such as Tysers can review your current policies and risk exposures to ensure you have adequate cover in place.

It is also important that clients make their broker aware of any changes such as new machinery or increased stock to ensure their policy will still be sufficient.

What is the Average Clause?

Insurers can apply the ‘Average Clause’ to claims made by underinsured businesses, which can result in a lower settlement amount than the policy limit.

If an insurer discovers that a business has inadequate insurance, the settlement can be reduced by the same percentage as the asset is underinsured.

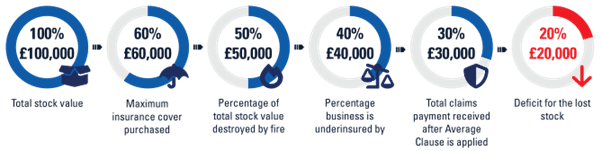

Claims example with the Average Clause applied

- Business A has stock with a total value of £100,000.

- When taking out insurance, the policyholder decides that they would be unlikely to lose more than 60% of the total stock. Therefore, they take out a policy with a maximum of £60,000 cover but do not inform the insurer of the total value of the stock.

- Fire destroys 50% of the stock, resulting in £50,000 of losses.

- The insurer deems Business A to be underinsured by 40% and applies the average clause. This results in Business A receiving only £30,000 (60% of the insured damages).

- This leaves Business A with a £20,000 deficit for the lost stock, which would have been covered if the policyholder had given an accurate stock valuation to the insurer.

Common areas of underinsurance

Plant, machinery and equipment

Unexpected problems with plant or machinery can be very costly, and it is important to consider not only the direct costs of replacing machinery or equipment but all the costs associated with delays to production, fulfilment of orders and additional labour costs.

The British Insurance Brokers’ Association (BIBA) strongly advises that all machinery (both hired and owned) is insured for the full value of replacing ‘new-for-old’.

In addition, delays caused by any specialist machinery that would take a significant amount of time to replace must be accounted for.

Supply chain delays have been significantly exacerbated in recent years by a combination of factors, including the backlog caused by the Covid-19 pandemic, Brexit and the Ukrainian conflict.

Contents and stock

Underinsurance of contents and stock is another potentially costly oversight which could leave a business struggling with out-of-pocket stock and equipment replacement costs.

Delays in replacing stock due to financial difficulties can also cause significant periods of business interruption, leading to more losses while the business is unable to resume normal trading.

When taking out a policy, it is important to determine the costs of replacing all stock and contents on a ‘new-for-old’ basis, even if a complete loss of stock or contents seems unlikely to happen.

The total figure is required by your insurer (even if you wish to select a lower amount of cover), as insurers use this to establish the total level of risk they are insuring.

Covid-19 and Brexit have both caused significant supply chain disruptions over the past few years and, as a result, some businesses have chosen to increase their stock levels.

It is crucial that the broker is made aware of any changes, as the cover provided by the current policy may be less than the required replacement cost for the new stock levels.

Additionally, the insurer may deem the insurance inadequate and apply the ‘Average Clause’, resulting in a lower settlement amount.

Buildings underinsurance

Underinsurance of buildings can have devastating consequences if fire, flooding, or other physical events cause major damage or destruction and there is a considerable shortfall in funds to rebuild.

In some cases, the high out-of-pocket rebuilding costs, in addition to long periods of business disruption, can lead to businesses having to scale back operations or even cease trading.

Despite this, research by the Royal Institute of Chartered Surveyors and the Building Cost Information Service suggests that around 80% of commercial properties have an element of underinsurance.

Many factors contribute to building underinsurance, some of the most common are:

Out-of-date valuations

Properties which have not been professionally valued recently for insurance purposes are at risk of being underinsured, therefore a commercial property valuation for insurance purposes should be a priority for business owners.

In addition, any extensions, alterations or changes of use must be accounted for and property owners should inform their broker as soon as possible about any changes to ensure the property is covered appropriately.

Changes of use

Covid-19 resulted in many businesses changing layouts or altering their premises to comply with social distancing guidelines, including utilising areas or buildings not normally occupied by employees.

If a business has expanded recently into new areas of trading or business activities, this may involve new equipment and stock, increased building capacity or change of use for some building areas.

Whatever the reasons for change of use, it is important that the business’s broker is aware of these changes to ensure that the business is not underinsured.

Market Value vs Rebuild Costs

Business owners often make the mistake of insuring for the market value of the property, rather than the full cost of a rebuild.

Market value is often not an accurate reflection of the cost to rebuild a premises, and other features such as car parks, driveways, lighting, fencing, and gates are often overlooked.

When calculating rebuild costs, estimates should include materials and labour, professional fees such as architect and planning costs, legal fees, demolition or make-safe costs, site clearance and access costs.

If the property is a listed building, it will typically take longer and cost more to rebuild, as these buildings must use specialist materials and traditional construction methods.

Buildings that are furnished to an unusually high standard (including those with eco-friendly features) or that have been constructed using unconventional materials may also be more costly and time consuming to rebuild.

Business interruption

There are many scenarios that should be considered to fully understand how a business’s trading could be interrupted.

From physical events such as a fire or flood, to supply chain disruptions and cyber-attacks, multiple factors will inevitably influence how long a business would need before it resumes normal trading following a major incident.

Selecting a much shorter period of cover for business interruption than the likely period of actual disruption is a common oversight, leaving businesses with ongoing additional costs after insurance pay-outs have ceased.

When selecting a cover, it is also important to note that the definition of profit used for business interruption insurance is different to the definition of profit for accounting purposes.

Gross profit for business insurance is defined as turnover less the cost of raw materials and other expenses directly variable with turnover.

Cyber liability

Despite almost 40% of businesses reporting a cyber security attack or breach in the past 12 months, many businesses still do not have a standalone cyber liability policy which would provide adequate cover in case of a cyber-attack or data breach.

Often, there may be limited levels of cover provided through a commercial combined or other business insurance policy, but this cover is usually limited and, therefore, can be insufficient for businesses that store or handle sensitive data or personally identifiable information.

A comprehensive cyber insurance policy will provide financial compensation for the direct costs incurred by the business, and any liabilities payable to third parties following a cyber-attack, data breach or loss of data.

Many policies also offer Cyber Breach Response Support, which is an invaluable resource when dealing with cyber-attacks. These services can include crisis containment, PR and reputation management and independent legal advice.

Contact Tysers today

Our expert construction brokers are here to help. Whether you require risk management expertise in one particular area or a programme of bespoke covers designed to protect all current and emerging risks, get in touch today or visit our website for more information.