Retirement communities could relieve the UK’s housing market crisis by offering affordable housing options and freeing up larger homes

The UK is facing a shortage of affordable housing for all age groups, including seniors. Retirement communities, however, present a potential solution to this problem.

One such retirement community is the ecology-focused haven for over 55s; Burnham Waters – currently being developed in Burnham-On-Crouch, Essex.

Burnham Waters’ Project Director, Ian Holloway, is incredibly well-versed in exactly how retirement communities could help to relieve this housing market crisis.

Having previously discussed a much-needed “churn in the market” on BBC Radio Essex, Ian understands important nuances surrounding this topic.

The UK housing market crisis

‘The UK housing market has been in crisis for several years, with a shortage of affordable homes across the country.

According to a 2021 report by the National Housing Federation, 8.5 million people in England have some form of unmet housing need.

This shortage has resulted in rising house prices, making it difficult for many people to afford a property and get on the ladder.

‘In addition to this shortage of affordable housing, the UK is comprised of an ageing population; the number of seniors aged 85 years and over is projected to double over the course of the next two decades.

Should this estimation be correct, we can naturally expect to see an increase in those aged 55 years and over, too.

‘This demographic shift has generated a growing demand for retirement housing that fulfils seniors’ needs, including those who require specialised care.

As such, retirement communities play a significant role in the realities of our housing market.’

‘Last-Time Buyers’

‘The government’s efforts to resolve this housing crisis have largely centered around first-time buyers. However, this may not be the best approach.

In fact, a report conducted by Shakespeare Martineau, which investigates this complex social and economic issue, suggests that a shift in focus to ‘last-time buyers’ would be far more effective.

‘This report states that the majority of Brits aged 65+ are currently living in a home with more bedrooms than they need; most likely the same property within which they raised their children.

Considering our ageing population, this must be addressed as soon as possible.

The UK requires far more age-appropriate housing, in addition to more effective communication surrounding retirement communities and what they can offer residents.

‘Shakespeare Martineau’s report even suggested that, should more of the UK’s population live in homes better suited to their needs, the nation would need to build a whopping 50,000 fewer homes each year.

Ultimately, if more money and resources were invested into the creation of integrated retirement communities that fulfil the genuine needs of seniors, more large-scale homes would subsequently become available for younger generations.

Moving into these communities would be appealing to seniors, igniting a crucial churn in the market.’

Downsizing your property

‘The ageing population occupies a great deal of larger homes, which can be particularly difficult for younger people to afford.

A 2020-21 English Housing Survey, conducted by the Department for Levelling Up, Housing & Communities, reported that over half (52%) of senior home owners live alone, presumably with far more space than they need.

Moreover, the senior respondents who reported living alone cited lower average scores for life satisfaction.

By moving into retirement communities, seniors can downsize their homes, allowing younger families to purchase larger properties better suited to their needs, whilst discovering higher levels of life satisfaction in turn.

‘Despite this evidence, many seniors are apprehensive about exploring retirement communities.

After all, the idea of downsizing can seem daunting. This is why a more effective showcasing of retirement communities’ benefits is so crucial.

‘It’s worth noting, of course, that retirement properties are not simply smaller by default.

This is often the case as it aligns with what many seniors feel they need at that stage of their life, but some retirement communties – like Burnham Waters – offer huge properties! These are ideal for those looking to enjoy a more luxurious quality of life upon retirement.’

Showcasing retirement communities

‘Along with a reluctance to downsize, The Shakespeare Martineau report also outlines a general misunderstanding of what retirement communities are – including what they offer.

When asked why respondents would avoid a retirement community, common responses included: “I believe I will lose my independence” and “I believe I will be more isolated from friends and family”.

‘In actuality, The Associated Retirement Community Operators (ARCO) conducted a huge study which found that those residing in retirement communities reported staying healthier for longer, felling less lonely, remaining socially active, and enjoying an improved sense of security.

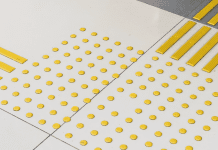

‘Every retirement community will boast different benefits, but, depending on where they look, a potential resident is likely to find anything from an enhanced landscape, with a focus on ecology and biodiversity, to a wide range of shared facilities or even a shared car scheme.’

Specialised care for seniors

‘Retirement communities offer specialised care for seniors, should they require it. Many retirement communities offer assisted living and memory care services, too, which can be far more expensive when provided elsewhere.

By moving into retirement properties, seniors can receive specialised care they may not have had access to at home, or simply feel comforted by the fact it’s available should the need arise.

‘Of course, specialised care is not a necessary component of retirement living – this is an incorrect assumption. High quality communities cater to all mobilities and preferences.’

Creating jobs and boosting local economies

‘Jobs are created, and local economies boosted, by the employment opportunities and subsequent revenues that are generated by retirement communities.

According to a report on the state of the adult and social care sector conducted by Skills For Care, adult social care is a significant economic contributor, adding an estimated £51.5 billion per annum to the economy in England in 2021/22 alone.

‘Retirement communities offer a range of job opportunities, including caregivers, nurses, chefs, and maintenance workers.

By generating economic activity, retirement communities contribute to the growth of local economies.’

Enhanced socialisation and community engagement

‘Retirement communities offer a range of social activities and events that enhance socialisation and community engagement among their residents.

Many seniors face social isolations which can have negative effects on their physical and mental health.

The supportive environment synonymous with retirement communities, however, allows seniors to engage with their peers, participate in activities and events, and maintain a strong sense of community.

‘It has been reported that loneliness costs the UK economy a staggering £2.5bn every year, with a great deal of this cost stemming from the elderly.

By providing a supportive environment that encourages social engagement, retirement communities help to reduce the cost of loneliness and improve seniors’ quality of life.

Overall, investing in retirement communities promises to benefit both seniors and society as a whole, making this a critical consideration moving forward.’