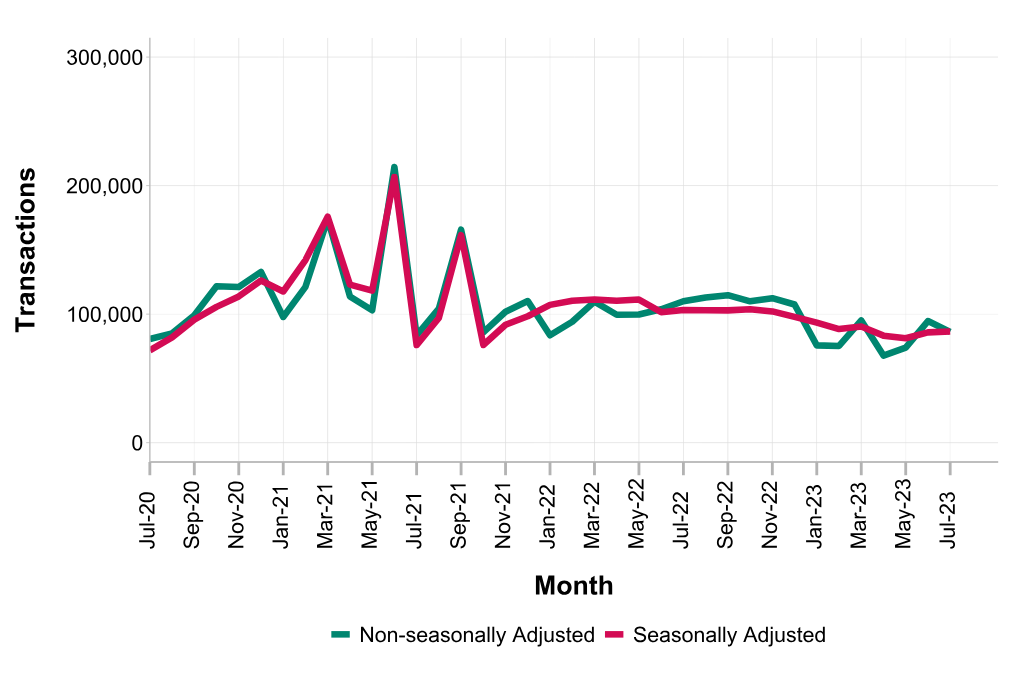

According to the latest HMRC property report, the number of residential property transactions was down by 16% in July compared to the same time last year

Figures show that 86,510 residential property transactions were recorded in July 2023.

July is the second consecutive month where there has been a small increase in seasonally adjusted transaction figures compared to June.

March 2023, in particular, saw a spike in non-seasonally adjusted transactions due to a larger number of working days relative to April and the final month for purchases to complete under the government’s Help To Buy Equity Loan Scheme.

Non-residential property transactions are slowly on the rise

HMRC’s property transactions also showed that there was a 3% rise in UK non-residential transactions in July, which follows a 5% increase in transactions from May to June.

There were 9,770 non-residential property transactions in July 2023, 6% lower than June 2022 and 3% higher than June 2023.

Construction industry reactions to the latest HMRC property transactions

Andy Sommerville, director of Search Acumen, commented: “Year on year, we’re now seeing reductions in transaction volumes across residential and commercial markets. Despite some progress being made in the battle against inflation in recent months, living and operational costs still remain very high by historic standards, as does the cost of borrowing. It is unavoidable that these dynamics will impact demand and pricing.

There is likely to be a period of reduced activity until income and borrowing costs become more balanced

“This marks a significant recalibration of the market dynamics that prevailed in the decade preceding the Pandemic. In the housing market, we are looking at a period of reduced market activity until house prices, real income, and borrowing costs come into better balance.

“In the commercial markets, we will see investors reassessing their portfolios, looking for sectors that are capable of outperforming all property benchmarks in the current conditions.”

Housing is likely to be at the forefront of government strategies in the near future

Nick Leeming, chairman of Jackson-Stops, added: “Activity may be down year-on-year, but it’s still within touching distance of the numbers seen throughout the mid-2010s, despite the low-interest rate environment being firmly in the rearview mirror.

“Mortgage rates are slowly heading back in the right direction and while rate cuts have been incremental, borrowers will be relieved and have a chance to catch their breath following a turbulent 12 months.

“Heading into Autumn we expect housing is likely to be a defining topic of conversation at the political party conferences and expect it to be central to the major parties’ long-term strategies. Reforms to planning, greater devolution to local councils and green energy infrastructure are all important topics of conversation for Sunak and Starmer to address to give homebuyers confidence that a brighter future lies ahead.”