By challenging perceptions around offsite construction methods and Modern Methods of Construction (MMC), Buildoffsite aims to ensure improved MMC education is provided so that the sector does not face barriers to increasing adoption moving forward

At the beginning of 2021, BECG commissioned Buildoffsite to provide MMC education on the challenges in the adoption of Modern Methods of Construction (MMC) and how these can be overcome. A survey was conducted of the Buildoffsite membership and also promoted to the sector via industry roundtables and stakeholders including the CIH [Construction Industry Hub], CLC [Construction Leadership Council], and Offsite School.

Mapping the ecosystem of the offsite supply chain

Understanding the offsite industry landscape, through improved MMC education, is key to knowing the barriers which exist today for offsite adoption. Offsite construction methods and MMC is based on two key components: efficiency and quality through the manufacture and preassembly of components, elements, or modules before installation on site.

Replace the second paragraph with: From the responses we received to the survey, 13% were from principle buying organisations using MMC solutions and over half of these were water companies utilising offsite construction methods for infrastructure projects.

Trends in the MMC market

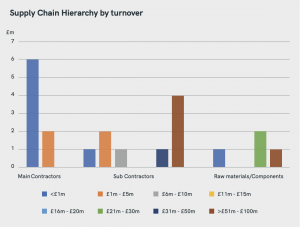

Our survey demonstrates that the main contractors are still behind the curve in the adoption of MMC and the understanding of MMC education, while the sub-contractors (an even spread of turnover from £1m up to £100m per annum) make up the majority of the MMC market surveyed.

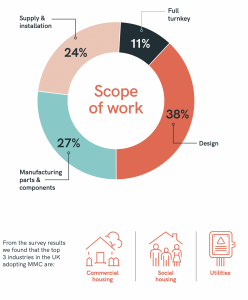

We found that full turnkey solutions (design to manufacture, supply and installation) make up just a small fraction of the market – just 11%. Breaking down the types of services provided we can see from the chart below that design makes up 38% of the service delivery.

Geo-political risks for delivering MMC projects

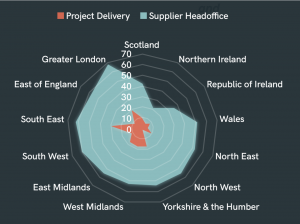

We wanted to find out where the market is based and where the opportunities are – both at home, and overseas. Most of our respondents are based in London and the South East – which is where much of the work is.

45% of our respondents said that geography wasn’t a barrier to them – which is positive but that’s still 55% of the market who feel that they’re missing out on opportunities because of logistics and location.

Most respondents were based in the South East of England and many projects are currently delivered to the Greater London region from MMC. In terms of levelling up, there is more to do in the UK&I to ensure the manufacturers and projects have a more even distribution. The Midlands and North of England are performing less well for MMC adoption, which will no doubt be a key element for the new MMC education Taskforce at MHCLG to focus on.

The geographical location of projects was not an issue for delivering projects for 45.95% of respondents. Road was the most popular choice for delivery whereas rail and air were not considered at all for project logistics.

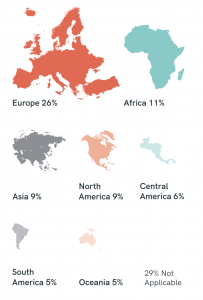

MMC distribution outside the UK&I

Globally, Europe makes up the largest proportion of overseas delivery for the UK&I MMC market 26% and makes up less than 30% of overall revenue. There was a small anomaly in the results showing over 80% of revenue was from overseas for one respondent, however, they are based in the Republic of Ireland with much of their work being domestic.

Finally, 51% of respondents are not distributed overseas at all.

With the new Brexit deal there is unlikely to be a negative impact on the MMC market with import tariffs being at zero.

In real terms, the supply chain will need to be aware of changes in Europe which are now in force and are due

Optimism for MMC post Brexit

As of 1st January 2021, new public procurement notices are no longer posted on the Official Journal of the European Union [OJEU], and will now appear on the new Find a Tender website. Any advertised opportunities pre-Brexit will continue to appear on OJEU and will be concluded on OJEU.

Exemptions for Find a Tender areas before Brexit for contracts which were excluded and not posted on OJEU, such as Ministry of Defence (MOD) contracts or regional work in Wales, Scotland & Northern Ireland. Each of the devolved governments has separate portals for advertising opportunities, portal links are provided in the graphic below. Suppliers will need to be aware of using all portals to search and register their interest in any new opportunities.

The Cabinet Office has stated that the procedures for procurement will remain the same for bidding as follows; open, restricted and framework agreements. Financial thresholds will not change substantially but are currently under review. UK&I companies looking for opportunities in the EU can still find these on OJEU. Currently, the Cabinet Office is reviewing changes in the public sector procurement regulations and how contracts are awarded such as a move from MEAT [most economically advantageous tender] to MAT [most advantageous tender]. Any changes made in the Public Contract Regulations will need to fall in line with the principles of the Government Procurement Agreement in accordance with the World Trade Organisations Members including the UK&I. Therefore, changes would need to be transposed into law underscoring the three key pillars of procurement (transparency, integrity, fair treatment of suppliers), and expand to cover the value for money [VfM] efficiency and non-discrimination.

A key benefit to the supply chain in a revision of procurement processes post-Brexit will be earlier engagement with suppliers and constructive analysis of project outcomes and deliverables. This will open the MMC market to greater adoption and fits into the recently launched Construction Playbook guidance on public procurement.

Since the UK has exited the European Union and the single market there are three key changes suppliers need to be aware of if conducting any business, sourcing materials or labour, importing or exporting to the EU. These are Declarations, Customs Duties, and the Northern Ireland Protocol.

Declarations: All businesses must now submit declarations for both imports into Great Britain from the EU and exports from GB to the EU. This will inevitably be an increase in administrative burden and costs.

Border delays due to paperwork detailing origin, commodity codes and value of goods.

Customs Duty: Despite having a trade deal, duty will still be due on products that do not meet relevant ‘rules of origin’ This could have an impact on components and timber in the offsite market.

The Northern Ireland protocol: The Taxation Bill was introduced in Parliament on 8 December 2020. This is a new model for the VAT treatment of goods arriving into the UK. The previous VAT treatment for goods that are sold into the UK by overseas sellers was linked to EU rules; this link will remain for Northern Ireland (NI) unlike the rest of the UK.

A new Schedule 9ZA VATA will retain the acquisition tax rules for NI. Additionally, a new schedule 9ZB VATA covers the VAT treatment of goods imported into NI from non-EU countries and goods exported from NI to non-EU countries. It also covers the VAT treatment of goods moving between NI and GB in line with the NI Protocol.

The industry consensus is that 40% of SMEs are unprepared for the UK leaving the EU and are simply keeping businesses afloat under the current pandemic. With changes on duties and tariffs due in July 2021 from the EU there will be a lot of changes and updates required and impacts on margins, timescales, and administration.

Respondents were asked about the investment and skills available to their businesses.

It’s fair to say that our respondents don’t think there’s enough support out there for the MMC community from Government – especially in terms of guidance, skills and funding.

Considering the current pandemic and protracted lockdowns, only 35% felt they had the necessary advice and guidance to implement new working practices to protect employees.

Only 31% felt that there is enough support for skills, training and apprenticeships from the Government. Individual comments on this section highlighted that there was little training in the offsite sector, and no known support or training made available to businesses in the offsite sector.

Access to funding and grants were also seen to be lacking, with just 32% saying there is enough funding from Government, however in the individual comments there was a recognition that a lot of funding or grants for offsite construction methods were targeted at SMEs only, potentially hindering the entire supply chain.

A larger company may be able to make strategic use of funding to drive a faster step-change in offsite if funded centrally and pushed out to their supply chain.

Some felt getting funding for offsite construction methods was akin to fitting a square peg into a round hole, with the requirements for funding not existing for offsite.

Positively, however, there is also a clear desire from respondents to work together to deliver the benefits of offsite construction methods to buyers and the viability of making offsite a delivery option.

Accreditation & assurances for offsite and MMC

Reputation and trust are the foundations for growth. The MMC/offsite industry must stand behind the quality of its work. Quality assurance (QA) helps to prevent problems through planned and systematic checkpoints against:

- Additional costs when work has to be redone or repaired

- Damage to reputation

- Additional costs to the client when defects have to be repaired

- Serious injury

- Project delays

From the survey, 51% of respondents felt that accreditation was not a requirement. This seems to be a disconnect between buyers and suppliers when specifying new works orders. The NHBC and Premier accreditations accounted for 16% and 8% of current assurance in the supply chain.

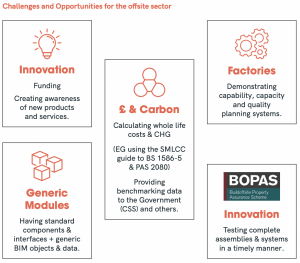

A lack of accreditation uptake goes some way to understanding the lack of adoption offsite construction methods, possibly because of the lack of confidence and viability as a solid construction project with robust assurances. Buildoffsite Property Assurance Scheme (BOPAS) is a risk-based evaluation which demonstrates to funders, lenders, valuers and purchasers than homes built from non-traditional methods and materials will stand the test of time for at least 60 years.

Procurement & supplier accreditation for offsite and MMC

Over 50% of the survey respondents were not on any formal sourcing platform for construction opportunities. The sourcing platforms listed were for private and public sector projects across the UK&I. These platforms enable both public and private procurement organisations to source suppliers meeting their criteria for project delivery. This lack of knowledge underlines the need for visibility of the offsite/MMC Supply Chain for research and technical specification scoping.

The government has launched the Construction Playbook where the adoption of MMC is encouraged for faster delivery of projects and at scale. This guide was published by the Cabinet Office in December 2020 and aims to:

- Provide greater certainty to the industry through long term plans for key programmes. This includes longer-term contracting across a range of areas which will give the industry the certainty required to invest in new technologies such as DfMA (design for manufacturing and assembly), delivering improved productivity and efficiency savings.

- Incentivising industry to innovate by focusing on the output of what we want a project to achieve, rather than micromanaging how it is done.

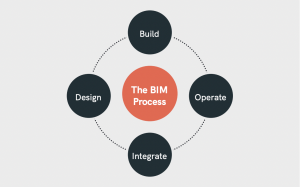

- Modernising construction by standardising designs and parts, as well as embedding digital technologies including the UK Building Information Management Framework.

This is a wide collaborative effort across UK BIM Alliance, BSI and CDBB. This plays a key component in pushing the adoption of MMC which is at the core a digitally designed solution.

These changes are greatly needed in the construction industry and a drive for adoption of MCC will ensure that the UK will see more investment in training and apprenticeships, driving forward innovation in construction, boosting productivity and focusing on value for money in the public sector developments.

MMC education for contract management

This was a key question to understand project delivery and management, and also highlighted what suppliers felt comfortable with from a contracting perspective – such as NEC 3 & 4, JCT or a framework contract.

The findings included that 21% of suppliers prefer NEC 3 & 4 contracts, which is a family of contracts unique in offering a complete end-to-end project management solution for the entire project life cycle; from planning, defining legal relationships and procurement of works, all the way through to project completion, management and beyond.

JCT and JCT D&B contracts were preferred by 18% of respondents where a design & build contract maintains control of the delivery but not the entire project.

Only 10% preferred a framework contract – which might be because there have historically been very few frameworks providing options for MMC exclusively, so by default exclude these suppliers based on the project delivery mechanism and turnover.

The contract preference is important as this is a key factor which has been picked up in the “Construction Playbook” and highlights the two preferred contracts: NEC 3 & 4 and JCT. The Construction Playbook warns that contracting parties must stress test contractual management to ensure innovation and use of MMC are not hindered indirectly:

“Standard construction contracts with appropriate options should be selected, save where the project or programme justifies a bespoke approach. Standard contracts should be chosen from the following suites:

- NEC 3 or NEC 4, as published by the Institution of Civil Engineers

- JCT 2016, as published by the Joint Contracts Tribunal

- PPC2000/TAC-1 and FAC-1 as published by the Association of Consultant Architects

Should different forms of contracts be used for specific reasons, compliance with the Playbook should be addressed explicitly in relevant governance and approvals processes (see chapter 4). Before issuing the tender, stress-testing and peer-reviewing the draft contract against the above elements can be helpful, particularly to check for unintended consequences. In doing so, ensure that the contract terms are not unintentionally limiting innovation, sustainable supply chains or investment in MMC.”

Opportunities for MMC and offsite construction methods

With public access to existing opportunities for construction projects wishing to use and apply MMC there are zero advertised on contracts finder currently. This could be due to the pandemic and market uncertainty around leaving the EU and public spending. However, opportunities that are listed on Contracts Finder have the specified building methodology and materials outlined for project delivery.

These are very prescriptive and exclude MMC or offsite construction methods as a service deliverable. Looking at the opportunities as we come out of the pandemic and the roadmap to recovery there are many untapped opportunities.

A recent report from The Construction Innovation Hub called Defining the Need outlines the scale of the market opportunity for platform/manufactured solutions across schools, housing, defence and hospitals, supporting a key policy ambition of the Government’s recently published Construction Playbook. This research was published in January 2021 and looks at how manufacturing, standardised processes have been used successfully across industries like automotive and aerospace leading to increased speed, efficiency, and the opportunity to invest in new technologies. The construction industry has been seen to lag behind but also recognises the benefits that come with the movement towards platform solutions/manufacturing and offsite construction methods. The Platform Design Programme has come at an opportune time and compliments and underscores the ambitious guidance in the Construction Playbook.

The publication of Defining the Need report, in conjunction with the Construction Playbook, puts a stake in the ground for the Construction Industry transformation, this could be called the Construction Revolution for greater automation.

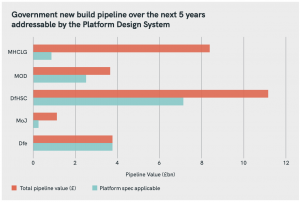

In addition to seeking to procure construction projects based on product platforms, the Government is encouraging public bodies to explore ways in which cross-sector platform systems can be applied. In 2020, the Construction Innovation Hub’s Platform team partnered with five of the government departments that will comply with the Playbook:

- Department for Education (DfE)

- Department of Health and Social Care (DHSC)

- Ministry of Housing, Communities and Local Government (MHCLG)

- Ministry of Justice (MoJ)

- Ministry of Defence (MoD)

All of these departments will work collaboratively to collate a cross-departmental data set of future requirements across a £50 billion five-year new-build pipeline.

“An analysis of the distribution of this pipeline spatially suggests that the most frequent space types across these departments are mid-span areas, which represent c.70% of space types. This reflects a predominance of general space types, nominally: circulation, bathrooms, storage areas, as well as classrooms and educational spaces. Whilst the hypothesis specification’s proposal to utilise a superstructure spanning up to 12m broadly aligns with this, the analysis undertaken suggest the hypothesis specification can be further refined to a superstructure spanning c.8m.”

By looking at space types, minimum building requirements, service life, facilities management, carbon lifecycle, & energy philosophy and frequency across such large departments enables the hub to create a list of common requirements which can be implemented across all departments utilising DfMA and economies of scale.

Whilst Defining the Need highlights the opportunities for the increased adoption of MMC across public sector social infrastructure, the Budget 2021 has presented further prospects for the delivery of vital housing needed within the UK. Through the announcement of the MMC education Taskforce, led by the Ministry of Housing, Communities & Local Government, the task force will set out to accelerate the delivery of housing using MMC and further develop MMC education.

The Budget 2021 also set out clear support in terms of the levelling up agenda, through the announcement of the Levelling Up Fund, the UK Community Renewal Fund and the Community Ownership Fund. These funds provide £5bn of support for vital transport, town and city, and community projects which will no doubt present opportunities for delivery utilising MMC.

In order to help deliver across these opportunities, Budget 2021 has also outlined additional support for R&D, skills and training for SMEs.

In a recently published offsite sector response to the government’s Construction Playbook, Buildoffsite explores how offsite construction methods can answer some of the challenges posed by the Playbook and has a demonstrated advantage. The 14 policies in the Playbook should result in:

- More whole-life, outcome-based specifications.

- Long term contracts.

- Greater use of standard designs, components and interfaces.

- More innovation and use of MMC.

- Greater exploitation of digital twins and collaboration tools.

- Increased speed of project delivery.

The scope of The Construction Playbook rightly extends beyond the completion of a project to consider whole life performance and costs. The offsite sector should consider the need to include in contracts provisions to ensure that any ongoing monitoring and control is maintained as designed and that any subsequent facilities/property management contracts include such provisions in their scope (possibly requiring a sub-contract service for some specialised aspects). This should form part of the “Soft Landings” process.

The Construction Playbook includes many points that the offsite community has been demonstrating or asking for greater consideration of for years. This could and should lead to significant growth in the sector.

Marketing departments need to develop robust benchmarking information (bang the drum), be ready to identify preliminary market consultations and invitations for novel solutions and be prepared to respond with offsite construction methods, with associated whole life cost and carbon assessments. If we want MMC to become the default choice for early project stages, we must enable designers to create generic models that enable competition when contractors are appointed and demonstrate that there is competition and capacity in the sector.

With the recent launch of the Construction Playbook, Defining the Need and the Green Revolution Pledge, 2021 could be a year for change and faster adoption/ delivery of projects. The Construction Playbook includes many points that the offsite community has been demonstrating or asking for greater consideration. It is now time for us to meet the challenges within it and make the most of this opportunity. This could and should lead to significant growth in the sector.

With the Budget 2021 setting out £ billions of support for the construction sector, there has never been a more opportune moment for MMC to continue to grow, develop and deliver at pace to provide the infrastructure, buildings and communities the UK needs. Many of the areas outlined below are underpinned by the announcements made in the Budget 2021. It is through collaboration and delivery of quality projects, supported by investment and Government policy and agenda, that MMC will step to the fore.

If we want MMC to become the default choice for early project stages, we must enable designers to create generic models that enable competition when contractors are appointed and demonstrate that there is competition and capacity in the sector.

Key areas and gaps to engage suppliers and potential developments for offsite construction methods are as follows.

1. Find opportunities in the Government’s agenda from The Construction Playbook, Defining the Need and the Green Revolution Pledge. These three key publications underscore the many opportunities to deliver MMC.

2. Align with the Government’s agenda through post-covid recovery, training, and set environmental ambitions by meeting carbon net zero targets.

3. Get your messaging right: marketing departments need to develop robust benchmarking information, be ready to identify preliminary market consultations and invitations for novel solutions, and be prepared to respond with offsite construction methods, with associated whole-life cost and carbon assessments.

Make Exiting the EU a positive step for offsite, through PR, marketing and case studies. Delivery of a home-grown manufactured solution offering viable delivery for projects across infrastructure, housing, healthcare and education. Through long terms plans for key programmes and longer-term contracting the desired outputs of project delivery nationwide can be unlocked.

Offsite and MMC education opportunities with local learning facilities

Engage local schools and colleges for apprenticeships, upskilling and employment opportunities in offsite.

4. Challenging perceptions through:

- Procurement training for buyers would be a large opportunity to drive mass adoption in the offsite industry. Through understanding the requirements of MMC and how to write clear specifications for all sectors, residential, commercial, healthcare and education.

- Raise awareness on agility and speed of MMC delivery: The pandemic has demonstrated that offsite construction methods can provide agile solutions and deliver at speed with less waste, defects and carbon neutral. These benefits embrace the targets set for construction in the UK on reducing embodied and operation carbon.

- Unlock the supply chain: There is a lack of visibility for the offsite supply chain and this needs to be addressed and aligned with traditional existing prequalification tools in the construction industry. This would create a one-step sourcing process for buyers to shortlist suppliers for relevant projects and tenders/pre-market engagement and research. This is a project Buildoffsite are currently trying to secure funding to deliver.

- Creation of a Toolkit for MMC education: A toolkit that will provide advice and guidance for the offsite supply chain would be an untapped opportunity for MMC education and enable greater access to projects across the UK, create training programmes and gain funding for innovation and expansion of manufacturing outputs. A booklet/brochure alongside a series of webinars for engagement, MMC education and harnessing new opportunities.

5. Bang the Drum

Show and Tell: Social media, local council representatives, and show off your regeneration work (both individual projects and through Local Enterprise Partnerships). This is how Strata Homes moved from traditional to MMC delivery.

- Work with the industry: Collaborate to deliver #WorkLocal campaigns to target MHCLG, Homes England and County Councils for forward planning of key projects to create pre-market engagement events for buyers and suppliers to open opportunities for offsite to deliver. Stock Increase Programme [SIP] is funded by the Housing Revenue Account with support from the Homes England Grant. This is targeted at delivering 3100 new council homes by 2028.

- Showcase successes, case studies and join an association like Buildoffsite that represents your interests and can assist you in collaboration projects and key networking events to bang your drum and share your success stories.